When you’re starting your supplement brand, it’s important to know your target audience. Without having a specific niche, it will be very difficult to gain any traction with your brand. So, who is the target market for nutritional supplements?

There are a variety of audiences for supplements. About 57.6% of Americans take some kind of supplement. The largest market for supplements is people over 60 years old who are looking to increase overall health and stave off diseases. Other large niches are vegans and sports nutrition enthusiasts.

The market for supplements is huge, so I’ll break it down for you so that you can understand where your brand fits into this picture.

How Many People Use Dietary Supplements?

According to research done by the CDC for the 2017-2018 period, they found that 57.6% of Americans had taken supplements. That means that about 190 million people use supplements.

Dietary supplements are a $71.81 billion dollar industry. The industry is also expected to grow by about 8% annually between now and 2028. 8% probably doesn’t sound like a lot, but that means that the industry will grow by about $5.744 billion in 1 year and will compound after that. There is a lot of room for growth and a lot of opportunity for small brands to get in on some of the growth.

Who is Buying Nutritional Supplements?

While athletes and vegans have a bigger voice in the supplement industry, the elderly are the largest group of supplement purchasers.

Remember, the target market for nutritional supplements are mostly women age 45+

The largest market is people 60 and older. They are more likely to be concerned about their health and longevity than younger individuals. They are also more prone to deficiencies as their bodies slow down and age.

Supplement use typically increases with age.

Women are significantly more likely to use supplements than men. For all people over the age of 20, 63.8% of women take supplements, while 50.8% of men take supplements. This is true for every age group that the CDC researched: about 10%-15% more women took supplements than men.

Among adults over 20, the age group that takes the least supplements is men from 20-39 years of age.

The target market for nutritional supplements

| Age Group | Men | Women | All |

| Over 20 | 50.8% | 63.8% | 57.6% |

| 20 – 39 | 35.9% | 49.0% | 42.5% |

| 40 – 59 | 53.8% | 64.4% | 59.2% |

| 60 + | 67.3% | 80.2% | 74.3% |

Why Are People Taking Supplements?

People take supplements for a variety of reasons. However, the majority of people seem to buy supplements for their general health. The most common type of supplement purchased is a multivitamin and mineral.

These are extremely common, and many people who purchase specialty supplements are also taking a multivitamin. These are super simple ways to make sure that you’re getting everything your body needs, which is why most people take them. The next most common supplements are vitamin D and omega-3 fatty acids.

Many people are just trying to improve their health, despite the fact that only a little more than 20% of people taking these vitamins actually have a dietary deficiency.

Among women, bone health is a major concern and one of the most common reasons for taking dietary supplements. Women are much more likely than men to develop osteoporosis, making bone health an important factor for them. Calcium is what many of them take.

After that, you start to get into more niche groups that take supplements. It’s in the niche groups where the opportunity is for the direct to consumer supplement entrepreneur.

Another big reason people take supplements is for energy and weight management. This involves people trying to lose or maintain their body weight as well as people trying to find an easy source of energy for their day. American adults are prone to getting too little sleep, living fairly sedentary lifestyles, and skipping meals, all of which deplete their energy levels, leading them to want a supplement to help with those problems.

A large sub-niche includes people from 20 – 40+ that want to improve their overall fitness. There are many supplements in this niche from pre-workout to muscle gain supplements and more. This category wants to achieve their fitness goals and often are looking to enhance the performance throughout their workout.

Botanical supplements are expected to continue seeing big growth as vegan and plant-based diets become more popular. There are a variety of reasons people chose this diet from moral objections to animal consumption, to health, and even climate concerns. Whatever the reason, vegan diets can be difficult to master and often leave people with certain deficiencies. Most vegans are forced to use supplements while partaking in their chosen diet.

The most common deficiencies among vegans and plant-based diets are Vitamin B12, Omega 3 fatty acids, Vitamin D, Iodine, Calcium, and Iron. There is a big growth opportunity to create brands selling these types of supplements as plant-based diets gain popularity and support from powerful groups.

However, these common vitamins are opportunities best for larger vitamin brands that have a brick and mortar precesses or an online Amazon or Walmart storefront. A more unique formulation and or a sub-niche problem like heart health, sleep, and brain health have more opportunity for the mid to small supplement companies selling direct to consumer online.

Of the different types of supplements, people who purchase vitamins are the biggest groups followed by botanicals, followed by proteins. If you look at revenue share industry-wide, vitamins take up about 30.8% of industry revenue.

But again it’s difficult for the mid-size or start up supplement business to compete against all of the competition and the narrow margins in the multi-vitamin space.

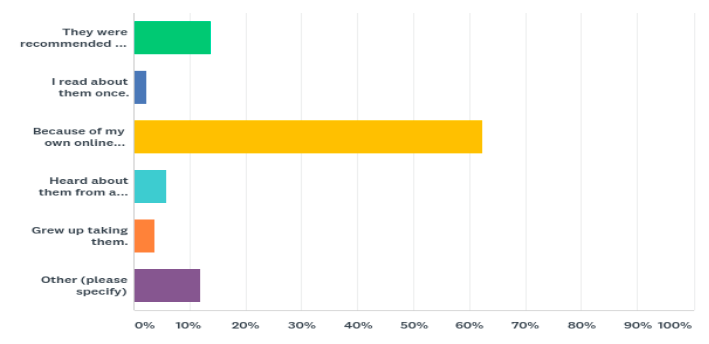

How Do People Decide What Supplements To Take?

Only about 23% of people taking supplements report being advised by a physician to do so. The most common reason for a doctor to recommend supplements, to women at least, is for bone health.

Everyone else tends to buy supplements based on their own research and recommendations from people close to them.

In fact the number one reason people decide which dietary supplement to take is because fo their own online research.

Over 60% of people make a supplement buying decision based on their own online research.

This is a big opportunity for marketing your supplement brand online.

I wrote a complete guide on how to market supplements, which you can read here.

The buying decision is different for dietary supplements. The most common mistake most marketers make is leading with science and treating their website like a standard eCommerce purchase.

Throughout my 10+ years working directly with supplement businesses my hypothesis that people buy supplements differently is proven over and over again.

Breakthrough The Supplement Revenue Ceiling

This diagnostic reveals the specific bottlenecks limiting your supplement brand’s revenue growth and provides a clear optimization pathway for breakthrough.

Listen to the Health Supplement Business Mastery Podcast for for dietary supplement entrepreneurs and marketers.